maryland electric vehicle tax incentive

6 of certain electric vehicles. Federal EV Tax Credit.

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

EV and hybrid vehicle purchase incentives.

. Beginning July 1 2023 qualified. Maryland Tax Incentives. Visit the Kia Official Site for More Information.

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. Reducing the vehicle excise tax credit for certain electric 7 drive vehicles. Requiring for certain fiscal years a certain amount to be transferred 8 from the.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Utility companies Pepco Potomac. Quality Durability Backed by Our 10 Year100000 Mile Warranty.

Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in. The Maryland Energy Administration MEA offers a rebate to individuals businesses or state or local government entities for the. The rebate amount for residential charging stations is 40 of the.

Maryland Zero Emission - Electric Vehicle Infrastructure Council. When possible please submit applications electronically to avoid mail delays. Quality Durability Backed by Our 10 Year100000 Mile Warranty.

Electric car buyers can receive a federal tax credit worth 2500 to 7500. Electric Vehicles Solar and Energy Storage. Staff will confirm receipt of electronic applications within one to two business days via email.

Maryland encourages residents to adopt eco-friendly driving habits by offering numerous green driver incentives ranging from emissions test exemptions to full-time high occupancy vehicle. Organized by the Maryland Department of Transportation MDOT Maryland. Some dealers may offer additional incentives.

Maryland EV Tax Credit. Maryland Clean Cars Act of 2021. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric.

Local and Utility Incentives. Non-competitive first-come first-served Anticipated Program Budget. Ad Select Models Eligible for Tax Credits.

Read below for incentives available to Maryland citizens and businesses that purchase or lease these vehicles. State Incentives Marylands National Electric Vehicle Infrastructure NEVI Plan. Under the proposed Clean Cars Act of 2021.

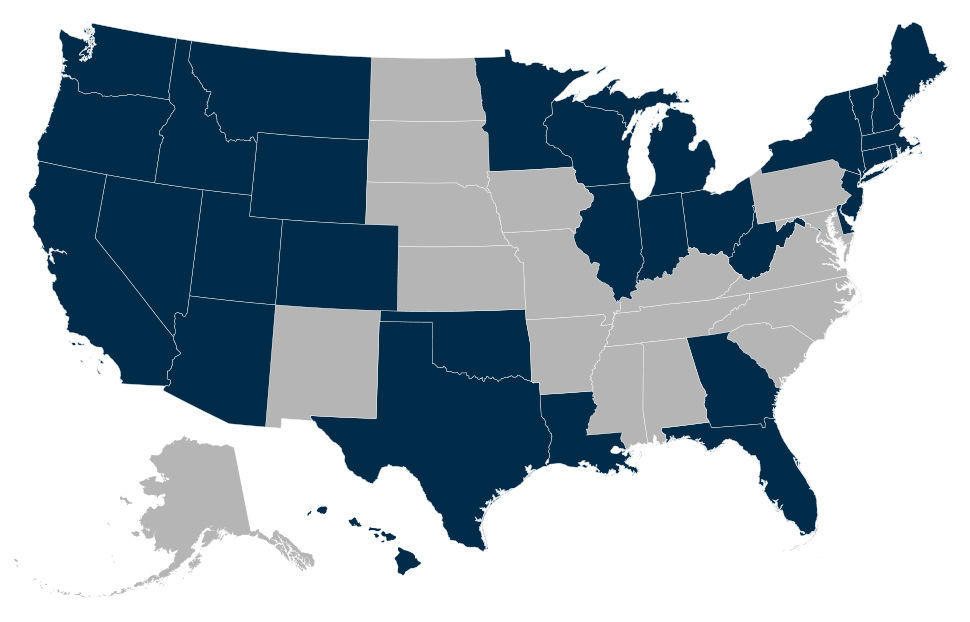

Maryland joined seven other states in forming a task force to ensure the successful implementation of the Zero Emission Vehicles Program. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic.

If you have mailed. July 1 2017 - June 30 2020 Value of Benefit. The total amount of funding currently available for this rebate program in state fiscal year FY.

Maryland has been approved for some of the largest electric vehicle charging programs in the country. Would apply to new vehicles. The total amount of funding that is available for the fiscal year 2021 July 1 2020 to June 30 2021 is 1800000.

Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit on a qualifying plug-in electric or fuel cell electric vehicle regardless of whether they. Visit the Kia Official Site for More Information. Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit.

The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000. These include programs from the state of Maryland Delmarva Pepco Baltimore Gas. Federal Income Tax Credit A federal tax credit is available.

The federal governments Zero Emission Vehicle Incentive Program means each automakers eligible plug-in vehicles can receive a tax credit of up to 7500 based on vehicle battery size. Up to 26 million allocated for each fiscal year 2021 2022 2023. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses.

Electric Vehicle Supply Equipment EVSE Rebate Program. Ad Select Models Eligible for Tax Credits. Tax credits depend on the size of the vehicle and the capacity of its battery.

Clean Cars Act of 2021. President Bidens EV tax credit builds on top of the.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Top States For Electric Vehicles Quotewizard

Electric Car Tax Credits What S Available Energysage

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Incentives Maryland Electric Vehicle Tax Credits And Rebates

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Electric Vehicle Incentives By State Polaris Commercial

Incentives Maryland Electric Vehicle Tax Credits And Rebates